I’ve always been fascinated by visionary investors, and Cathie Wood’s journey to the top of the finance world is one of the most compelling stories I’ve come across. As a young Cathie Wood, she had a vision for the future of investing focused on disruptive technology. With incredible drive and determination, she founded ARK Invest and built it into a globally recognized firm.

I wanted to understand how she did it, so I dove into her history. Let me take you on the journey I discovered, from her early life to the creation of one of the world’s most talked-about investment firms.

Key Takeaways

Early Vision Shaped by Mentorship: Mentored by economist Arthur Laffer at USC, Cathie Wood launched her finance career in 1977, building expertise over decades at firms like Jennison and AllianceBernstein.

Bold Leap to ARK Invest: In 2014, at age 59, Wood founded ARK Invest after her disruptive innovation ETF idea was rejected, starting with her own capital and focusing on AI, robotics, DNA, energy storage, and blockchain.

High-Conviction Success: ARK’s flagship ARKK ETF surged 150% in 2020 on bets like Tesla (predicted to hit $4,000 pre-split), managing over $20B in assets by mid-2025 despite volatility.

Revolutionary Transparency: ARK’s open research ecosystem shares free papers, models, daily trades, and social media insights, breaking Wall Street barriers for retail investors.

Empowering Long-Term Innovation: Wood’s philosophy democratizes access to high-growth tech investing, sparking global conversations on disruptive technologies and fostering a new generation of visionary investors.

Table of Contents

Who is Cathie Wood?

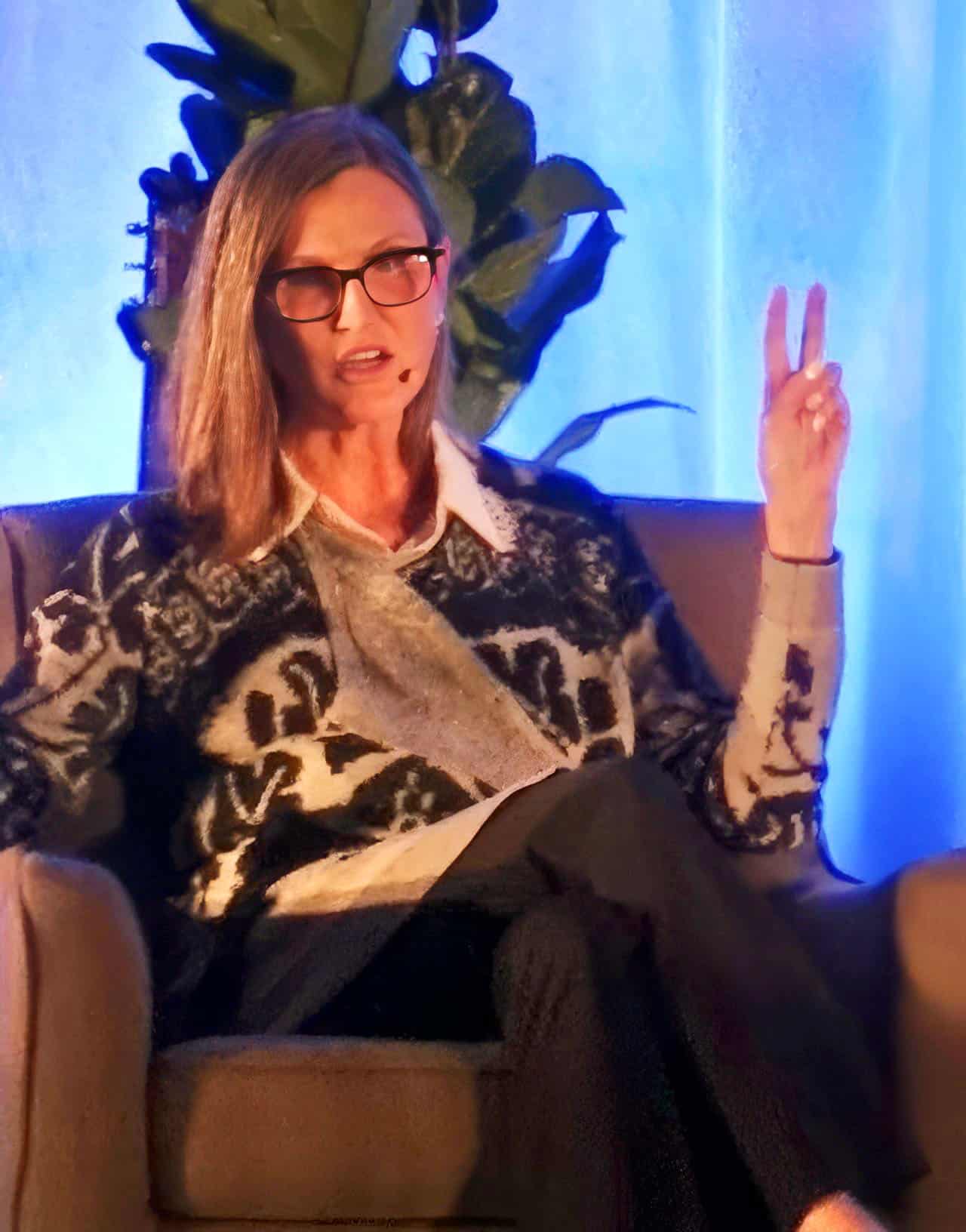

Catherine “Cathie” Wood is a pioneer in the finance industry, best known as the founder, CEO, and CIO of ARK Invest, an investment management firm headquartered in St. Petersburg, Florida. She has built a reputation for her conviction in “disruptive innovation,” focusing on technologies like artificial intelligence, gene editing, robotics, and blockchain.

Born in Los Angeles in 1955 to Irish immigrant parents, Wood’s interest in technology and economics was sparked early on. Her father was a radar systems engineer for the U.S. Air Force, giving her a firsthand look at the power of innovation. This foundation set the stage for an ambitious career that would challenge the conventions of Wall Street.

As of mid-2025, ARK Invest manages over $20 billion in assets, a testament to Wood’s vision that resonated with millions of investors worldwide.

Early Life and Education of a Young Cathie Wood

Growing up, I remember hearing stories about ambitious people who forged their own paths. Cathie Wood’s story is a prime example of this. Her early years were defined by a strong work ethic and a curiosity about how the world works.

Formative Years and a Key Mentor

After graduating from an all-girls Catholic high school in Los Angeles, Wood attended the University of Southern California (USC). It was here that she found a pivotal mentor in economist Arthur Laffer, who was one of her professors. Laffer, known for the famous “Laffer Curve,” saw her potential and allowed her, as an undergraduate, to take his graduate-level classes.

This mentorship was crucial. Laffer helped Wood land her first job in finance in 1977 as an assistant economist at Capital Group. In 1981, she graduated summa cum laude from USC with a Bachelor of Science in finance and economics, ready to make her mark.

Building a Decades-Long Career

Wood’s career path shows a clear progression, with each role building on the last. She spent decades honing her skills long before launching ARK Invest.

- Jennison Associates: In 1980, she moved to New York City and joined Jennison Associates. She spent 18 years there, serving in multiple roles including chief economist, portfolio manager, and managing director.

- Tupelo Capital Management: In 1998, she co-founded the hedge fund Tupelo Capital Management. By 2000, the fund managed approximately $800 million in global thematic strategies.

- AllianceBernstein: She joined AllianceBernstein in 2001 as the Chief Investment Officer of Global Thematic Strategies. For 12 years, she managed over $5 billion, focusing on high-growth, innovative companies.

Her time at AllianceBernstein was formative. It was there that she developed and tested her ideas about investing in disruptive technology, even when it meant underperforming the market, as she did during the 2008 financial crisis. This experience solidified her conviction in her long-term vision.

The Rise of ARK Invest

Cathie Wood truly made her mark on the finance industry when she decided to launch her own firm. ARK Invest was born from an idea that her previous employer deemed too risky, a decision that ultimately launched one of the most-watched firms on Wall Street.

A Leap of Faith and a New Model

In 2014, at an age when many are thinking about retirement, Wood proposed creating actively managed exchange-traded funds (ETFs) focused solely on disruptive innovation. When AllianceBernstein rejected the idea, she didn’t give up. Instead, she left the firm and founded ARK Invest herself, initially using her own capital to get it started.

The name “ARK” is not only an acronym for Active Research Knowledge but also a reference to the Ark of the Covenant, reflecting her deep Christian faith. This new venture was built on a unique philosophy.

ARK’s core belief is that innovation is the key to long-term growth. The firm focuses on five main platforms: Artificial Intelligence, Robotics, Energy Storage, DNA Sequencing, and Blockchain Technology.

Building an Investment Empire

ARK Invest quickly became synonymous with high-conviction bets on companies like Tesla. In 2018, Wood famously predicted Tesla’s stock would hit $4,000 per share (pre-split) when it was trading around $300, a call that proved prescient. This bold, public-facing approach became a hallmark of the firm.

The firm’s flagship fund, the ARK Innovation ETF (ARKK), delivered a stunning return of nearly 150% in 2020, making Wood a household name among investors. This success led to massive inflows, and by early 2021, ARK was one of the top 10 largest ETF issuers. However, the journey has been volatile, with ARKK experiencing a significant drawdown in 2022 before rebounding. This volatility highlights the high-risk, high-reward nature of her strategy.

Cathie Wood’s Legacy

Cathie Wood’s name has become synonymous with “visionary,” and for good reason. Her journey from a young analyst to the CEO of ARK Invest is a story of ambition, hard work, and an unwavering belief in the future.

Let’s take a closer look at the legacy she has built.

Making Investing Accessible

For me, one of the most inspiring parts of Cathie Wood’s story is her commitment to democratizing investment research. Unlike traditional Wall Street firms that keep their analysis private, ARK has an “open research ecosystem.”

What does this mean for the average person?

- Public Research: ARK publishes its research papers, articles, and valuation models for free on its website.

- Social Media Engagement: The firm’s analysts, including Wood herself, actively engage with experts and the public on social media to share ideas and refine their theses.

- Transparency: ARK discloses its trades daily, allowing anyone to see what its funds are buying and selling.

This level of transparency was revolutionary. It broke down the walls between Wall Street and Main Street, giving everyday investors access to institutional-grade research.

Empowering the Average Investor

At its core, Wood’s vision has always been about empowering investors. By creating actively managed ETFs, she provided a vehicle for people to invest in high-growth, innovative companies without needing the massive capital required for hedge funds. Her funds gave millions of retail investors a seat at the table.

Through her frequent media appearances and public research, she educates people on complex technologies and encourages a long-term mindset. While her strategies are debated and her funds’ performance fluctuates, her impact is undeniable. Cathie Wood sparked a conversation about the future of technology and changed how a generation thinks about investing in it.

People Also Ask

Who is the young Cathie Wood?

Cathie Wood is a visionary investor and the founder of ARK Invest, a firm focused on disruptive technology. Born in 1955, her early career began in 1977 after being mentored by economist Arthur Laffer at the University of Southern California. She spent decades in roles like chief economist and portfolio manager before founding ARK Invest in 2014.

What is ARK Invest?

ARK Invest is an investment management firm that focuses on disruptive innovation. It manages several actively managed ETFs that invest in technologies like AI, robotics, DNA sequencing, energy storage, and blockchain. The firm is known for its open research policy, sharing its analysis and daily trades publicly.

How has Cathie Wood achieved success?

Cathie Wood achieved success through a high-conviction, long-term investment strategy focused on innovative companies. Her willingness to make bold, contrarian bets on technologies and companies like Tesla and Bitcoin, combined with a transparent research process, attracted a massive following and led to periods of extraordinary returns for her funds, most notably in 2020.