Ever stare at your bank account between paydays and think, “Where did it all go?” You’re not alone. Managing money as a freelancer is like playing a video game on hard mode.

One month you’re celebrating a huge client payment, the next you’re counting pennies.

Here’s the thing: 28% of skilled knowledge workers now freelance, and collectively they generated $1.5 trillion in earnings in 2024

That’s a ton of money flowing through hands just like yours. But most freelancers mix business expenses with personal finances, which makes tracking profits and handling quarterly taxes way harder than it needs to be.

This post breaks down simple, practical steps for keeping your freelance finances from spiraling out of control.

You’ll learn how to set up a SoFi business account, handle quarterly taxes without the panic, and actually build an emergency fund that works. If you want to stop stressing every time invoices roll in, keep reading.

Key Takeaways

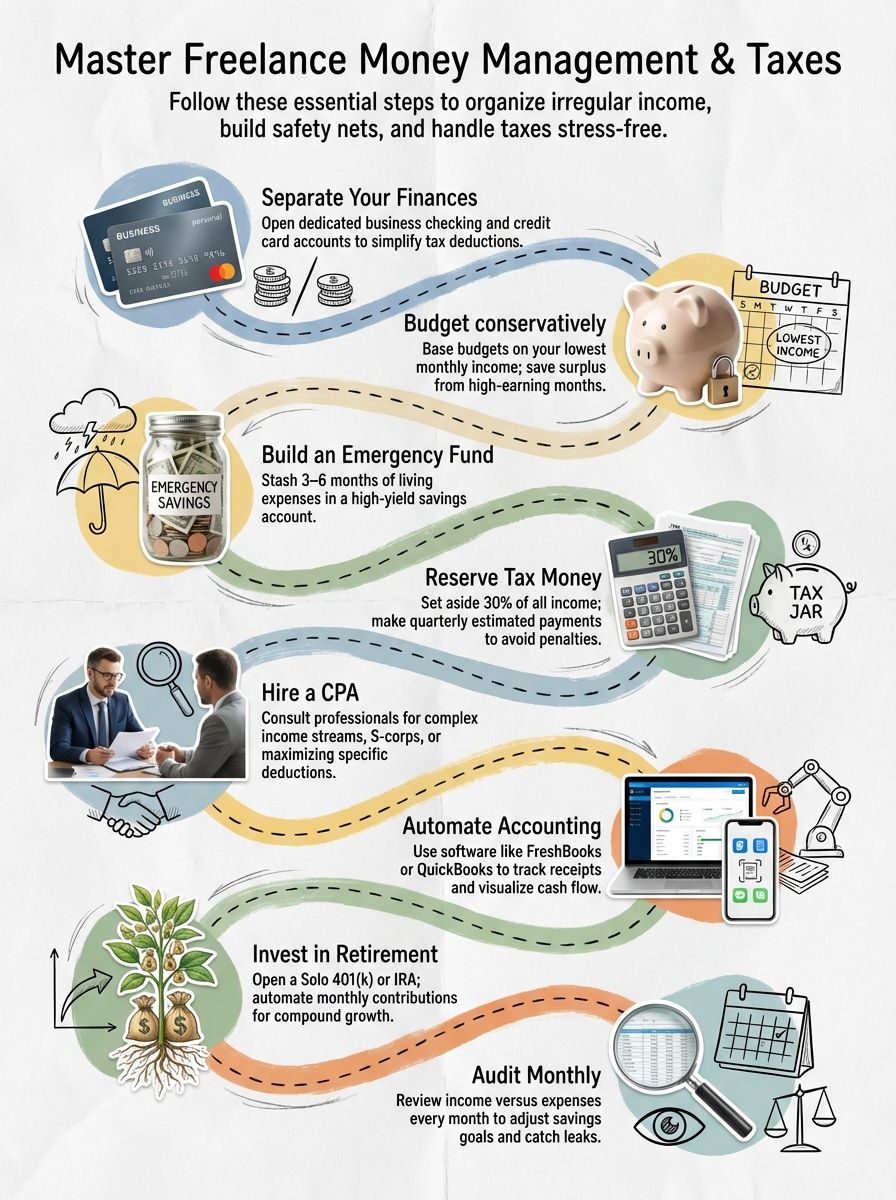

Freelancers should open separate business accounts and credit cards to simplify tracking expenses and maximize tax deductions.

Experts recommend saving at least three to six months of living expenses in a high-yield emergency fund, with $500 as an initial goal for new freelancers.

Set aside 30% of freelance income for federal taxes, including the 15.3% self-employment tax on the first $184,500 of net earnings for 2026.

Use accounting tools such as FreshBooks or QuickBooks to track weekly cash flow, organize receipts, and prepare financial reports efficiently for tax season.

Automate monthly retirement contributions into IRAs or Solo 401(k)s to build long-term savings while taking advantage of compound interest.

Table of Contents

Separate Business and Personal Finances

Mixing business finances with personal income is like jumbling a box of puzzle pieces. Tax deductions and cash flow get messy fast.

Open a business account, grab a separate credit card for your freelancer gigs, and save yourself chaos at tax time.

How do I open a dedicated business bank account?

Freelancers need two separate bank accounts to keep personal income and business finances apart. First, pick a bank that offers fee-free business accounts.

Banks will ask for your legal name, proof of identity, address, and details about your freelance work like invoices or tax documents. Some banks require membership eligibility checks before opening an account.

To establish a clear business profile, set up utility bills under the company’s name. I did this myself last year: having my receipts flow into one dedicated account saved time come tax season and made tracking those sneaky deductions easy as pie.

If you want better financial management without headaches, check out SoFi personal banking. They offer tools for both freelancers and small businesses.

Why should I use a business credit card for expenses?

Using a business credit card for freelancer finances keeps your spending clear as day.

All purchases for work go to one place, making tax season much easier. If the IRS asks about deductions or audits your records, clean bank statements save tons of stress.

My first year freelancing looked messy with mixed receipts in my wallet and kitchen drawers. Once I got a dedicated business credit card, sorting cash back from client lunches and software subscriptions felt smooth as butter.

Responsible use builds up your business’s credit history fast. This helps if you want better commercial loan rates or gear up for bigger projects later on.

Stick to one or two cards so you don’t end up tracking a dozen bills every month while chasing down federal income taxes and payroll numbers!

Budget for Irregular Income

Irregular income can make your budget feel like a roller coaster. But you can tame it with the right tricks.

Tools like spreadsheets help you plan for dips, so you never get caught short come payday.

How can I create a budget based on my lowest-earning months?

Use your lowest monthly income from the last 6 to 12 months as your baseline.

Calculate all fixed expenses first. These are your non-negotiables: rent, utilities, insurance, and debt payments. These stay the same even if you’re eating ramen twice a week.

Stash away any extra earnings from those rare fat paycheck months into a separate money market account or high-yield savings for leaner times. Use apps or simple spreadsheets to track every bit of cash flow, no excuses.

The best way to budget with irregular income is to pay yourself a steady paycheck each month. If your business earns more one month, move the extra income into a cash cushion fund and pull from it during slower seasons.

Divide total annual freelance income by twelve for your average month, but don’t trust averages alone. They can trick you faster than an algorithm update gone wrong.

Prioritize building an emergency fund so surprise bills do not throw off the whole budget. Three to six months’ worth is smart.

Sometimes picking up profitable IT side hustles during dry spells helps cover gaps without dipping into retirement savings or racking up credit card debt.

How do I track and plan for seasonal income fluctuations?

After setting your budget for slow months, it’s time to get smart about those income waves.

Study the last 12 months of payments to spot your busy and quiet times. Add up your fixed costs and compare them to each season’s average pay.

Save extra during big earning stretches, think summer web design surges or heavy December consulting gigs, to cushion lean seasons.

Split client work across industries, so if one dries up another flows in. This lowers risk while leveling cash flow.

Always keep a backup of three to six months’ essential expenses tucked into a high-yield savings account or money market fund for peace of mind when invoices run late or projects pause.

Build an Emergency Fund

Rainy days hit freelancers harder than most.

A solid emergency fund can soften the blow of lost gigs or late client payments.

How much should I save for an emergency fund?

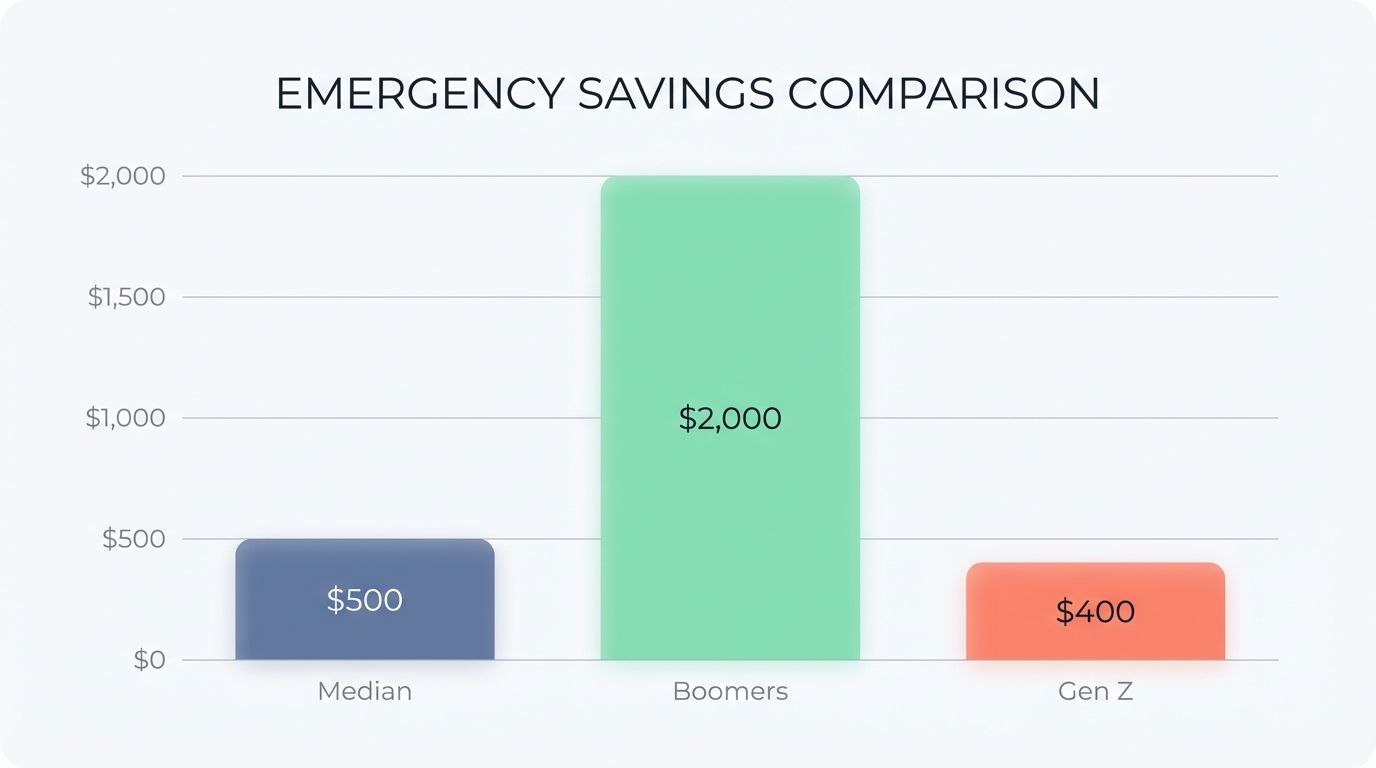

Experts say stash away at least three to six months of living expenses in a savings account for emergencies. If that sounds huge, aim for $500 first.

I started by saving $10 each week from my freelance gigs. In one year, I had over $500 ready for those “oh no” moments, like delayed payments or surprise bills.

The median emergency savings for Americans is $500. Boomers save a median of $2,000, which is five times that of Gen Z’s reserves of $400.

Think about your lowest-earning months and plan your emergency fund around them. Freelancers should keep at least three to nine months’ worth of normal expenses handy if possible. This is extra useful since invoice cycles can be slow. Sometimes clients take 30 days or more to pay up!

An emergency fund makes life less stressful and keeps you from falling into debt traps like payday loans or high-interest credit cards during tough times.

What is the best type of account for emergency savings?

Dedicated savings accounts are the strongest option for building a real emergency fund.

Go with an easy-access account where you can get your cash quickly if disaster strikes but without too much temptation to dip in for daily spending.

Skip connecting a debit card. It keeps impulse buys at bay and helps that savings plan stay on track.

Having at least $2,000 stashed away for an emergency can lead to better financial well-being, according to a 2025 study by investment management company Vanguard.

In my own experience as a freelancer juggling inconsistent salary months, stashing money into a plain online savings account made managing surprise tax payments and inflation spikes way simpler.

Plan for Taxes

Taxes can sneak up faster than a popup ad.

Setting aside cash for social security and medicare taxes helps you dodge panic and stay in the right tax bracket.

How much money should I set aside for taxes?

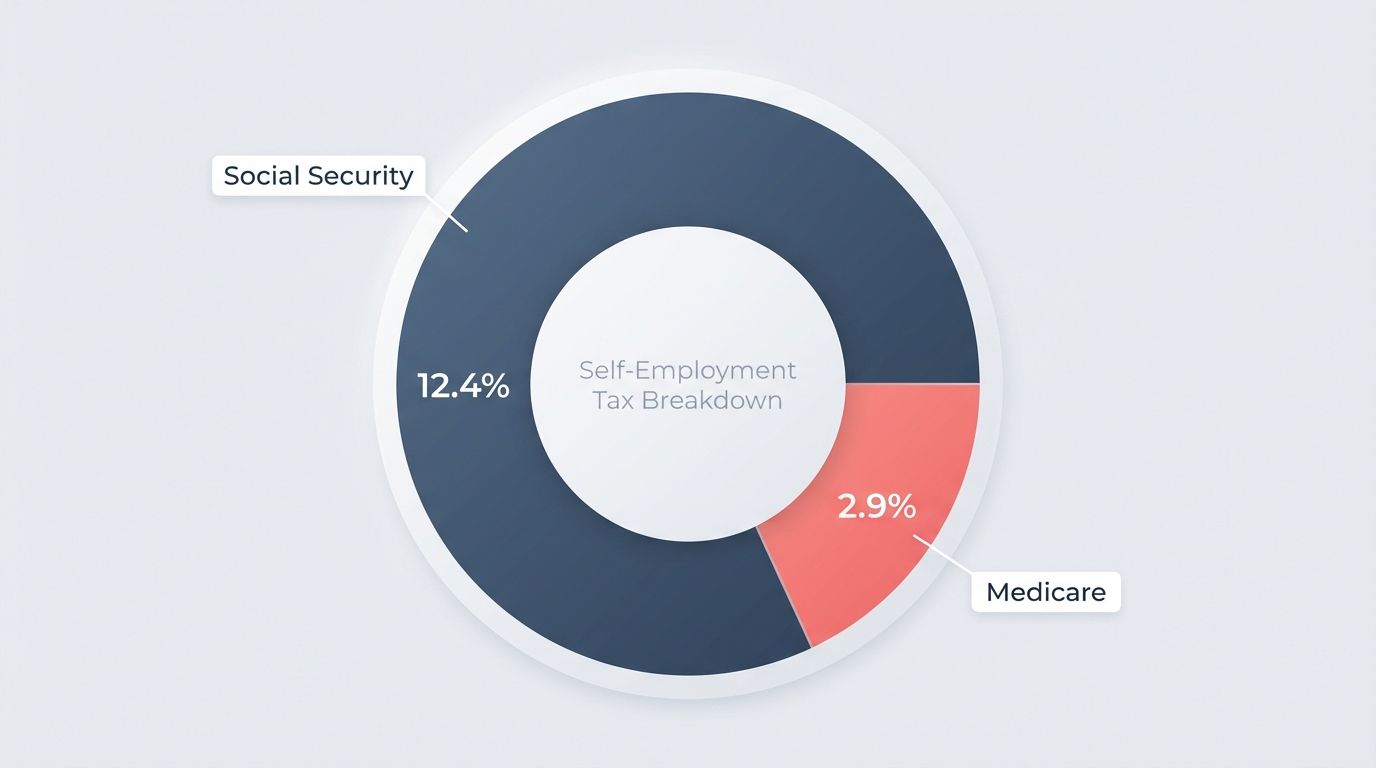

Set aside at least 30% of your freelance income for taxes, including self-employment tax.

The self-employment tax rate is 15.3 percent: 7.65 percent for the employee portion and 7.65 percent for the employer portion. The 15.3 percent reflects a 12.4 percent levy for Social Security and 2.9 percent levy for Medicare.

Financial advisors and most accounting software tools suggest saving about one-third just to play it safe.

Plan to make estimated payments quarterly using Form 1040-ES if you expect to owe at least $1,000 for the year.

In 2026, estimated tax payments are due April 15, June 16, and September 15. The final due date is January 15, 2027, which applies to income earned in the fourth quarter of 2026.

Most geeks round their number up. So if your math says save $1,400, pop away $1,500 instead.

Divide your best estimate by four, now you have what should go into your “tax piggy bank” each quarter. This tactic helps dodge late fees and keeps Social Security and Medicare taxes covered while keeping your cash flow steady between gigs or side quests.

When should I consult a tax professional or CPA?

After figuring out how much to stash for taxes, you might hit a wall. It happens.

Just last year, I found myself tangled in dividends and juggling business structures like S corporation versus sole proprietor. Startups should pull in a CPA from day one if possible. Trust me, those $150 to $450 per hour fees pay off in saved time and stress.

If your freelance money streams come from multiple clients or cross borders, things get wild fast, especially with tax rules constantly changing.

Big life events such as marriage or divorce can flip your tax bill upside down. A certified pro will sort employer payments, check pension options like solo 401(k), handle retirement planning questions, or flag any discounts before tax season trips you up again.

Always research tax pros carefully by checking their credentials and reviews first.

Use Financial Tools

Financial tools help geeks zip through money management with ease.

If you want to stay on top of invoices or eyeing a future mortgage, these platforms make your cash flow feel more like science than guesswork.

What accounting software is best for freelancers?

FreshBooks is a great example of accounting software that’s quirky and fun. When you start out, FreshBooks has scribbled tips everywhere to show you what will happen on each page. It’s as if a mentor took a pen and marked the important bits for you. It’s easy and intuitive to move around the app.

It helps track time, send invoices, handle expenses, and run simple reports, giving you financial freedom at your fingertips.

If you’re watching your wallet, Wave is free but drops the ball on scanning receipts.

For freelance and self-employed professionals in search of simple and free accounting software with strong invoicing features, Wave delivers. You can use Wave’s payment processing service, which involves a processing fee per transaction.

QuickBooks Solopreneur nails tax management and links right up to TurboTax for filing. Just be ready for a few odd menu clicks.

Dashboards in these apps show cash flow clearly. If you want a fast way to stay ready for taxes or even plan a pension, this software covers it better than any bookkeeper I ever paid out of pocket!

How do I track expenses and cash flow regularly?

Grab accounting software like FreshBooks, QuickBooks, or Wave to make things easy.

Most let you snap a photo of paper receipts and attach them right away, saving loads of time. I keep a digital folder in Google Drive. Each year has its own space, with months as subfolders. Every invoice and receipt sits in the correct spot.

Set up your software or spreadsheet to log every bit you earn and spend. A good trick? Log expenses weekly so nothing falls through the cracks.

If your brain works better visually, many apps offer colorful graphs showing cash flow spikes and dips throughout the month.

These tools help maximize tax deductions come April and give a clear view into whether money flows faster out than in on any given week. This is vital for anyone worried about retirement funds or building pensions someday as a freelancer geek!

Plan for Retirement

You want your future self to relax, play more video games, and eat pizza, so start saving now.

Retirement accounts let you open a savings account online in minutes. Automate deposits once a month and watch it grow while you debug code or build your next side project.

How do I open a retirement savings account as a freelancer?

Start by picking an account type.

Freelancers often go with a Traditional IRA, Roth IRA, SEP IRA, or Solo 401(k). Each has its own rules about who can use it and how much money you can put in.

In 2026, the maximum you can contribute to a Solo 401(k) is $24,500 as the employee plus an additional 25% of compensation as the employer with additional catch-up contributions opportunities if you are 50 or older.

Most banks, credit unions, or online brokerages let you open these accounts straight from your laptop, no need for fancy suits or face-to-face meetings.

You’ll need some basics: your Social Security number and proof of income. Have those handy so you don’t have to scramble later.

I opened one while eating pizza at my desk! Check out each provider’s fees and what investments they offer since that affects how fast your savings grow. Some folks even talk to a financial advisor first just to dodge rookie mistakes.

How can I set up automated retirement contributions?

After picking the right retirement account, like an IRA or a Solo 401(k), it’s time to put your savings on autopilot.

Most bank apps and retirement platforms let you schedule automatic transfers straight from your checking account.

I set mine to move 10 percent of each paycheck into my Roth IRA every month. This method helps me save even during slow months because the money disappears before I can touch it.

You don’t have to stick with one amount forever. If your business booms or expenses shrink, increase your monthly transfer with a few clicks in your app dashboard.

Regular deposits give compound interest more time to work for you. Even small amounts grow faster this way.

Set up these transfers during high-earning periods, think tax refund months or big project payouts, to boost long-term gains without missing a beat.

Regular Financial Reviews

Every month, fire up your spreadsheet and take a hard look at how much cash comes in and goes out.

Don’t let small habits drain big dreams.

How do I conduct monthly audits of my income and expenses?

Set a recurring date on your calendar each month for your financial review, and stick to it like it’s your favorite comic book drop.

Pull up your dashboard or whatever spreadsheet you like best, then download all bank statements and freelance invoices for the month. Check every penny in and out, review payments received, bills paid, plus any awkward charges that jump out at you.

Categorize everything with simple tags, such as “web hosting,” “coffee budget,” or “client software.” Compare what you spent against what you planned in your budget. Flag anything strange for follow-up.

Make notes if a client still owes you cash or if an expense felt out of place.

Update these records so tax time feels less like wrestling a Hydra and more like beating Level 1-2 on easy mode.

When should I adjust my budget and savings goals?

Earnings not looking steady?

Say you land a big contract, or hit a dry spell for months, right then is your cue to tweak your budget and save targets. After I switched gigs last spring, my checks went from sparse to fat real fast. I had to up the amount in my emergency fund and add new categories for gear upgrades.

Life throws curveballs too. A move across states or adding tiny humans means old numbers won’t cut it.

Quarterly reviews using tools like QuickBooks give you real talk about spending leaks or surprise expenses. If business grows, bump your savings goals before splurging on another mechanical keyboard.

Keeping an eye on industry rates helps keep your pricing current so you don’t fall behind on cash flow plans.

How Will Freelance Financial Management Evolve in 2026?

Freelancers will soon manage money in ways that seemed like science fiction five years ago.

48% of CEOs are planning to boost freelance hiring in the coming year, which means more tools and services will pop up to help you handle cash.

Financial apps may become essential, letting you track expenses, save for retirement automatically, file taxes with a few taps, and access growth tips written in plain English.

Simplified financial laws could help people keep more of their pay while helping governments collect higher tax revenues without complications. These changes mean that even rookie freelancers anywhere, from small towns to big cities, can start developing budgeting skills with the right tech available.

People Also Ask

How do I set aside money for taxes as a freelancer?

I recommend automating this with a platform like Found that partitions your tax buckets whenever a deposit hits. Setting a hard rule to route 30% of every check into a high-yield savings account ensures you never face a liquidity crisis in April.

What expenses can freelancers deduct to lower their tax bill?

Beyond standard internet bills, you can write off business-critical tools like GitHub Copilot, Adobe Creative Cloud, and even server costs. Just ensure you log every line item in software like Expensify, as the IRS requires documentation for every deduction on your Schedule C.

Should I pay estimated taxes quarterly or wait until the end of the year?

You should absolutely pay quarterly via IRS Direct Pay because the current 7% underpayment penalty functions like high-interest debt that compounds daily.

How can I manage irregular income when my freelance payments vary each month?

My favorite hack is using YNAB to “age” your money, which means you pay this month’s invoices with last month’s revenue. This creates a buffer that smooths out the variance between your high-bandwidth months and the inevitable quiet periods.