MetaTrader 4 is the definition of a super user-friendly trading platform for beginners. While not advanced for modern standards, it’s the perfect launchpad for newbies to eventually transition into complex software.

Here, you’ll learn all the essentials about navigating the MT4 interface.

What Is the MT4 Trading Platform?

MetaTrader 4 (MT4) is an online trading software launched in July 2005 by MetaQuotes, a Cyprus-based software developer. It’s the company’s fourth product in the MT series, which began in the early 2000s. MT4 is MetaQuotes’ most successful charting platform, synonymous with forex trading.

Besides using it for foreign exchange (forex or FX), users can speculate in other markets on the MT4 trading platform, like stocks, indices, commodities, and cryptocurrencies. MetaTrader 4 is among the easiest programs for developers to build trading ‘robots’ or automated trading systems.

You can access MetaTrader 4 on desktop, mobile, and web devices across most operating systems.

How Is MT4 Different From Other Forex Charting Platforms?

Simplicity differentiates the MT4 trading software from other names like cTrader, NinjaTrader, and TradingView.

MT4 is relatively stripped-down while boasting the necessary charting capabilities. This is perfect for beginners who can easily navigate different markets without being daunted by other advanced software early in their careers.

Another differentiator is the software’s low system requirements. Beginners can run MT4 on virtually 32-bit computers that use at least Windows XP (or equivalent).

Finally, countless derivatives brokers use MT4 for the above reasons. This is particularly prevalent in forex, where almost all brokers offer the former to their clients.

Navigating MT4’s Trading Software

Let’s look at the basic functions at a glance for MetaTrader 4. Knowing how to navigate the four most essential tabs will ensure you’re already on your way to mastering this software.

Most traders will use the File, View Insert, and Charts tab while on MT4. Within these tabs, only a few functions are necessary more than the others.

Utilizing MT4’s File Tab

- You can open a new chart by clicking the ‘New Chart’ sub-tab. A list of available markets will then appear.

- Traders can view deleted charts (Open ‘Deleted’).

- Profiles are a useful feature for grouping different chart settings for different markets.

- The ‘Save As’ function allows you to save profiles, chart templates, and other files in MT4’s back-end folders.

- The ‘Save As Picture’ lets one screenshot their chart.

- The ‘Open Data Folder’ option is where traders can see the back-end folders of the platform.

Below this sub-tab, traders can open a new account, log in to an existing one, log in to MT4’s web version, or log in to the MQL5 community.

Unpacking the Most Crucial Parts of the View Tab

- Toolbars: Near the top of the screen, you can remove or add charting-related aspects, like time frames and line studies. Traders may consider this option for a more clutter-free screen.

- Status Bar: You can add or remove the status bar below the screen, which primarily shows the strength of your internet on the MT4 servers.

- Charts Bar: you can add or remove this bar (essentially chart labels) just below your currently viewed chart.

- Symbols: This is where traders view the properties of each market offered by the connected broker on MT4.

- Market Watch: This allows you to view the live bid and ask prices for all assets the broker provides. Clicking on the market and dragging it towards the right opens its chart.

- Data Window: This window lets you see the date, time, open, close, high, and low information for a particular candle on your currently viewed time frame. Traders can also view basic data for any indicators they’ve placed.

- Navigator: This allows traders to see all the live and demo accounts, indicators, robots or expert advisors (EAs), and scripts available on MT4.

- Terminal: This is the section below a chart where you can see your account balance and the floating losses and profits of running positions. Traders can add or remove the terminal at any time.

- Strategy Tester: This is where you test your EAs or robots.

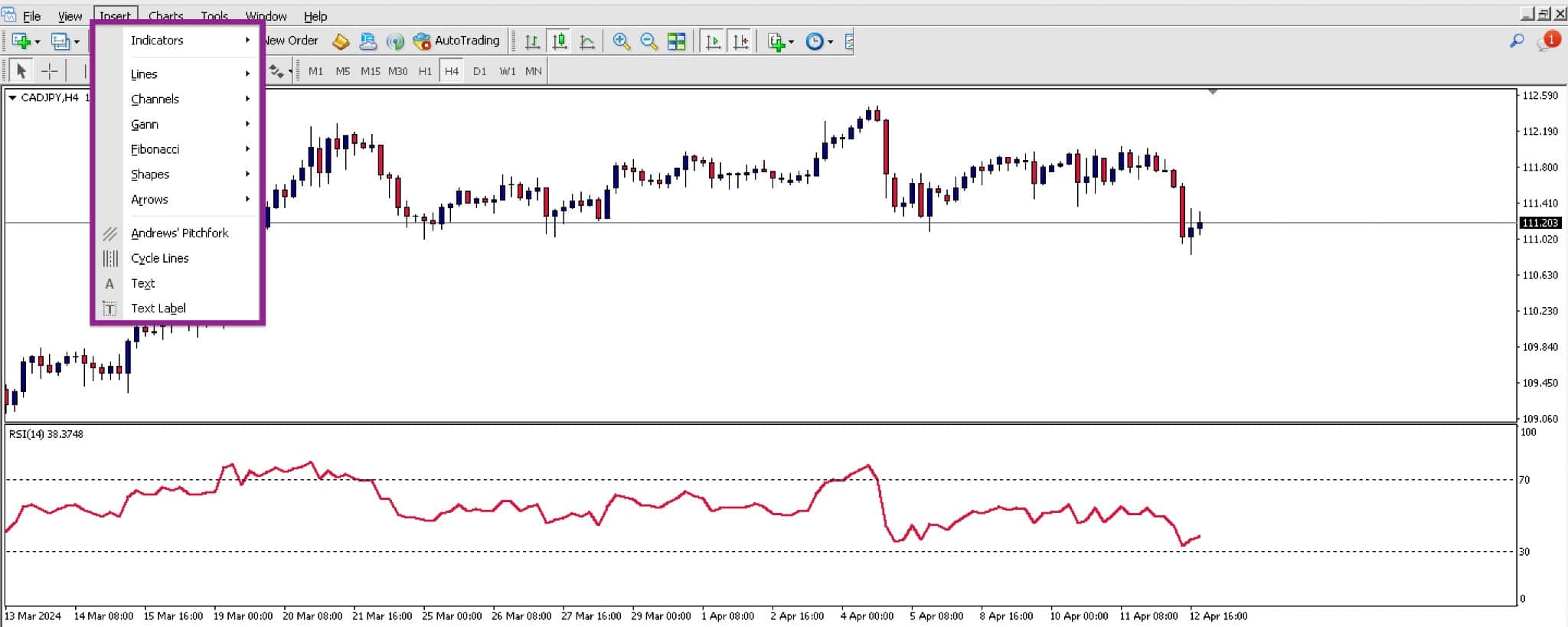

Using the Insert Tab

Now, let’s view the most used parts of the Insert tab, where traders choose the visual tools to place on their charts.

The first sub-tab, ‘Indicators,’ is a place any trader will be most familiar with due to their frequent usage. MT4 has 30 built-in indicators for traders to utilize.

The sub-tabs below the ‘Indicators’ tab are graphical or visual tools (lines, channels, Gann, Fibonacci, shapes, arrows, etc.) Traders use these tabs to add charts for analysis.

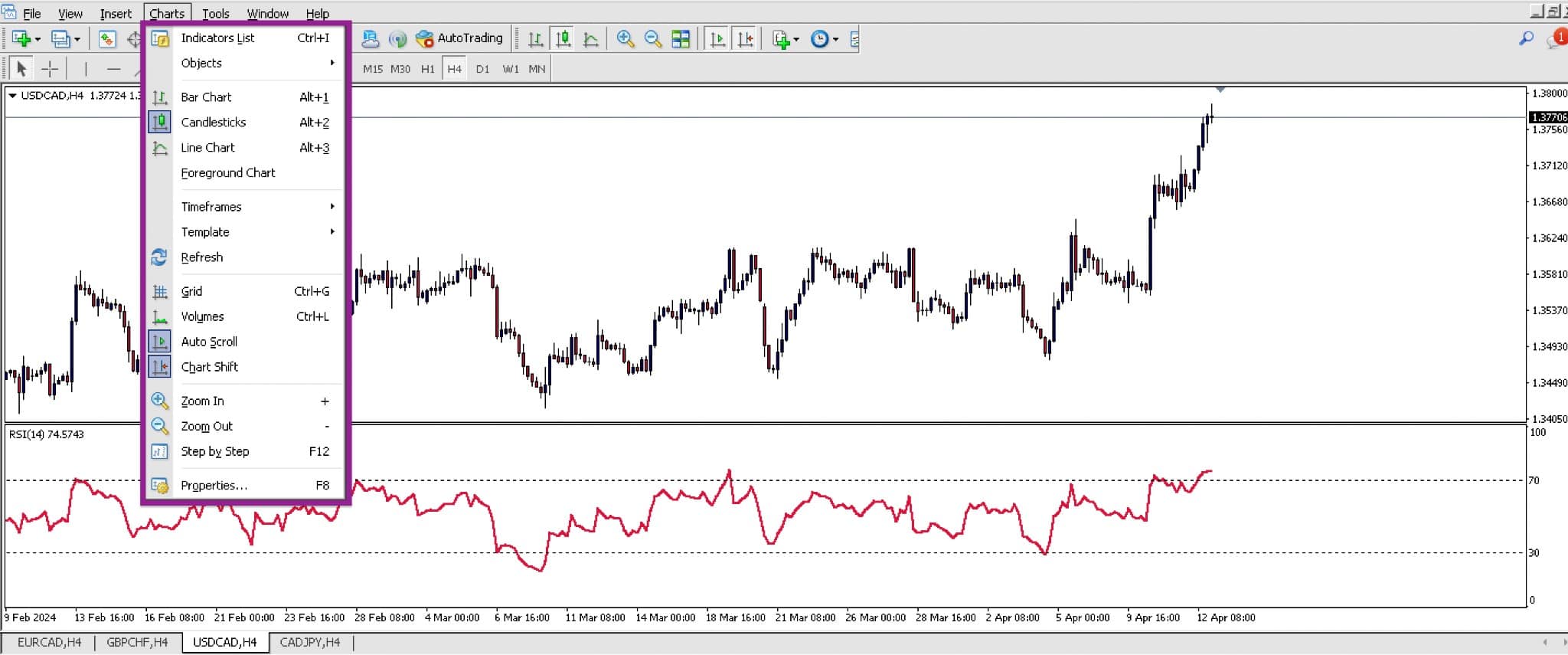

Using the Charts Tab

The Charts tabs are incredibly useful and are used by traders to:

- Delete any objects on their charts.

- Choose between a bar, line, or candlestick chart.

- Choose a timeframe (MT4 offers nine different time frames – one minute, five minutes, 15 minutes, 30 minutes, hourly, every four hours, daily, weekly, or monthly).

- Save, load, or remove a template.

- Zoom in or out when using their charts.

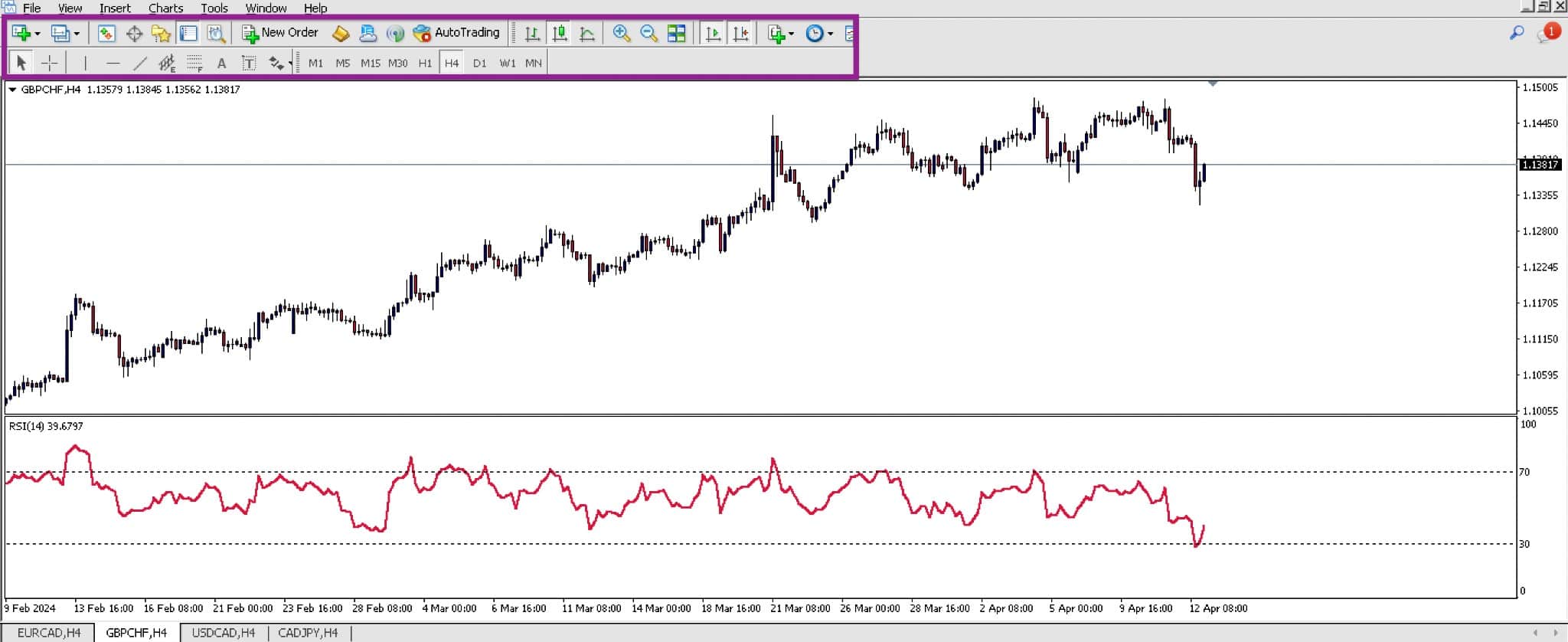

Second Line Functions

Some functions boxed in purple in the image above are also available in previously discussed tabs. Let’s briefly cover the most crucial functions and unpack their uses.

- New order: This function opens a window for you to execute a position. MT4 also offers one-click trading — an option that you find at the top left corner of your chart.

- Auto Trading: This is where traders turn a robot on or off.

- Bar, line, and candlestick charts: Traders find these chart types useful and important. This function allows you to cycle between these chart types.

- Crosshair: Once selected, dragging this function across two points allows traders to see the distance measurement and number of candles.

Pros and Cons of MetaTrader 4

Pros:

- Simple to navigate

- Free to use

- Supported by nearly all forex brokers

- Compatible with several third-party platforms like trade copiers, analytics platforms, and journals

- Functions with old operating systems and low system requirements

Cons:

- Not an advanced charting platform

- It has an old-school interface

- Limited historical data

- Slower execution speeds

MT4 Is Perfect for Beginners

Many experts will criticize the inferior charting abilities of MT4 when compared to the other modern platforms.

However, this is actually a benefit for beginning traders. MT4 offers the foundation for building their charting knowledge before moving on to professional software.